The property is a distribution warehouse acquired in 2019 by a major international automotive manufacturer serving its franchised retailers in New York and northern New Jersey. Over the next four years, CRS performed cost segregation studies for each of four phased expansions and renovations to the original 132,000 square foot building. This case study highlights the Phase 2 and 3 renovations, which cost a total of $19,395,000. Phase 2 involved gutting the building’s 30,400 square foot office area to add new offices, a board room, lunchroom, open office area, executive kitchen, coffee bar, wellness room, IT room, and bathrooms. Phase 3 was a renovation of the existing 75,200 storage warehouse to update its flooring, interior lighting, security system and loading dock equipment. Both phases were completed and placed in service in 2021.

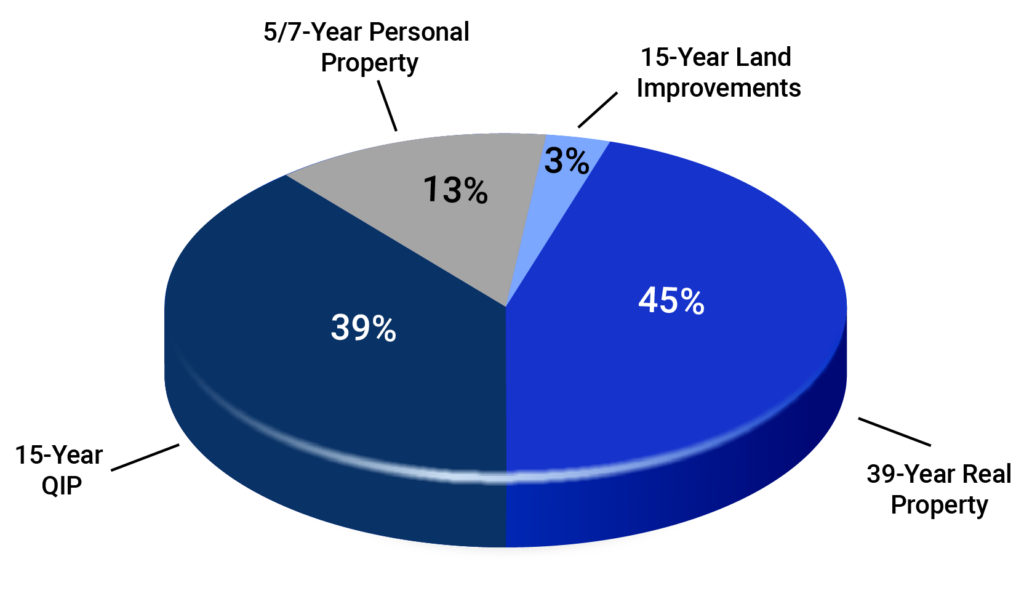

The interior improvements qualified for a special asset class called Qualified Improvement Property (QIP). When a building is renovated, many interior assets that normally would be allocated to a 39-year depreciation period are then eligible for a 15-year depreciation period instead (plus bonus depreciation). Our engineers were challenged to discern between improvements made to the structure and building envelope versus interior modifications. QIP on this property was significant, enabling the client to gain substantial tax benefits.

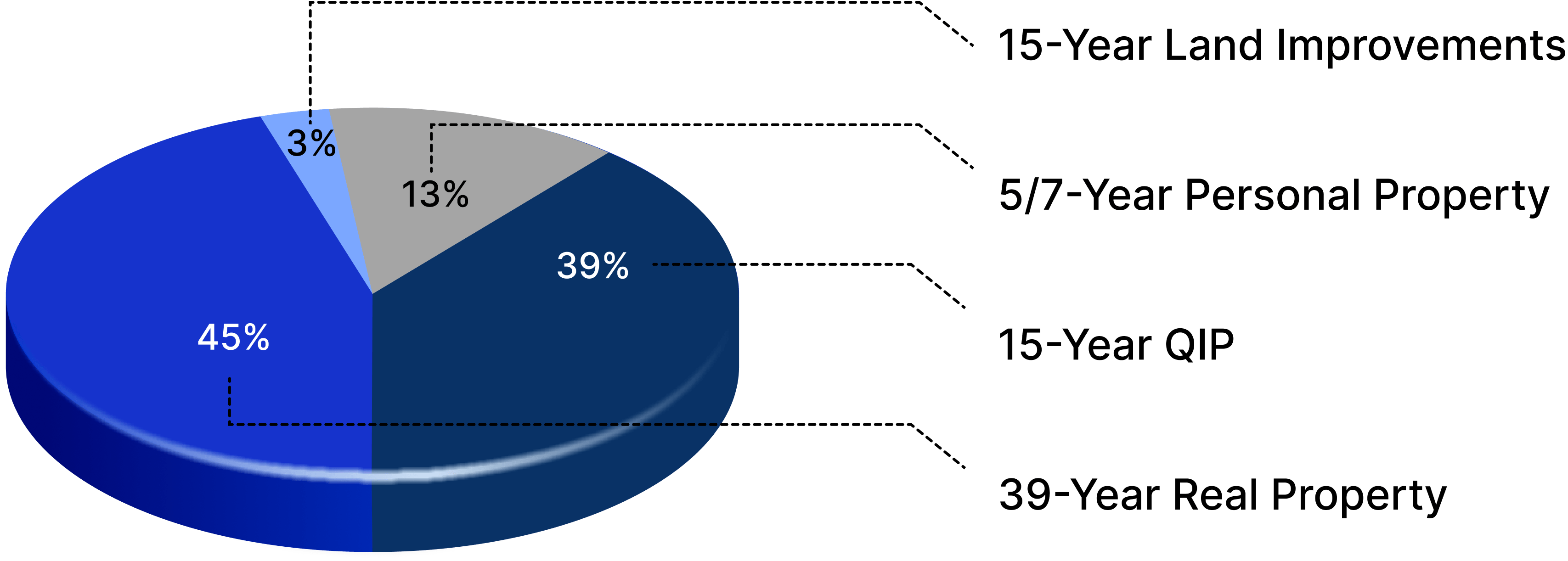

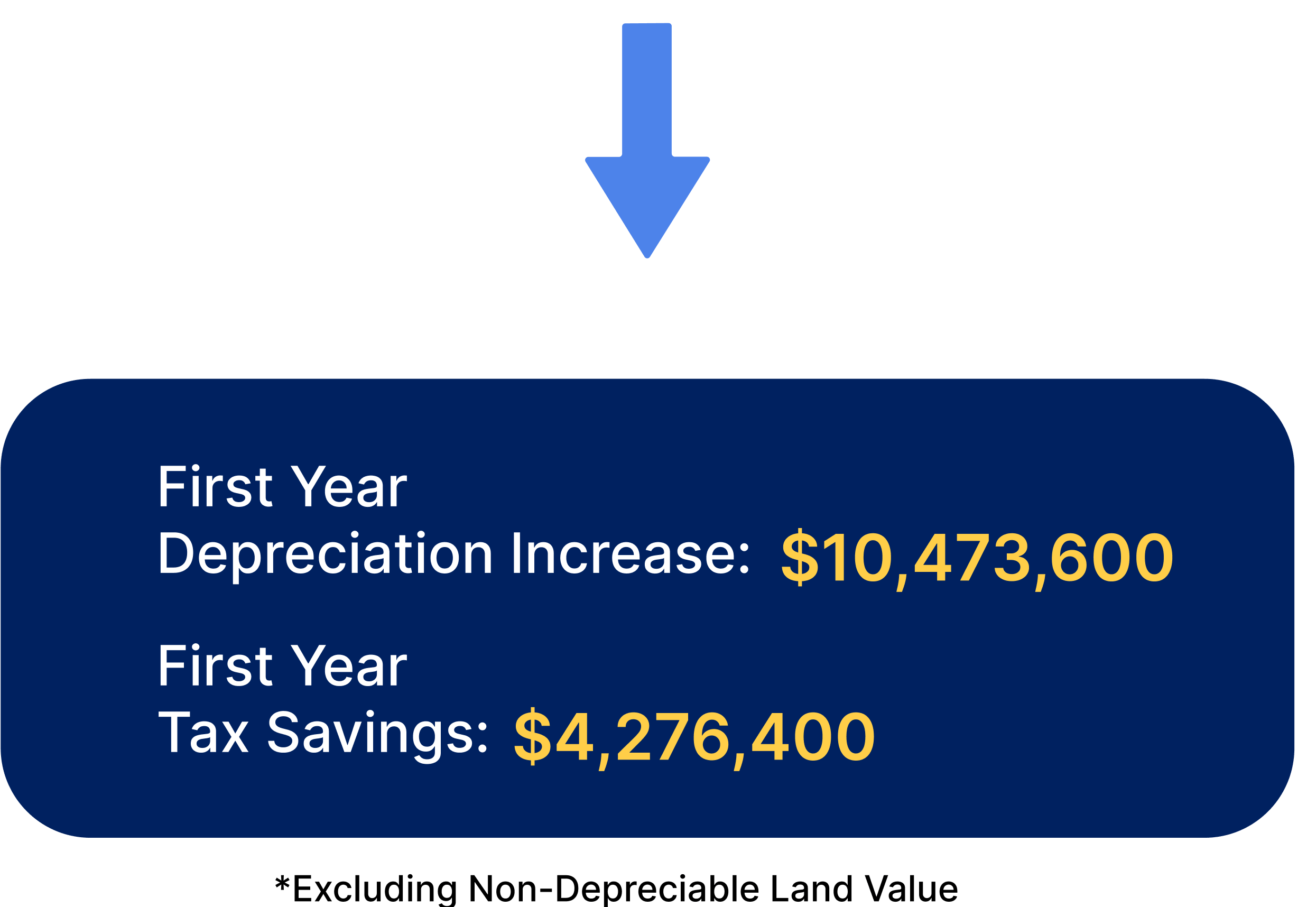

CRS reallocated a significant amount of the renovation assets to shorter depreciation periods, resulting in the following accelerated tax benefits and cash flow for the client.

Take control of your property’s tax burden and discover the hidden potential in your assets.

© 2025 Cost Recovery Solutions LLC