The property is a luxury, four-story apartment building constructed at a cost of $26,430,000 and placed in service in 2021. Located in southern New Jersey, the 227,000 square foot building includes 144 one- and two-bedroom apartment units in varying sizes, along with 43 individual garages on the first floor. A portion of the units are designated as affordable housing with more basic features and finishes. Amenities include a community lounge with wet bar, fitness center, game room, private balconies or porches on all units, outdoor patio and grilling station, bike and tenant storage rooms, electric car charging station, dog park, and dog washing station.

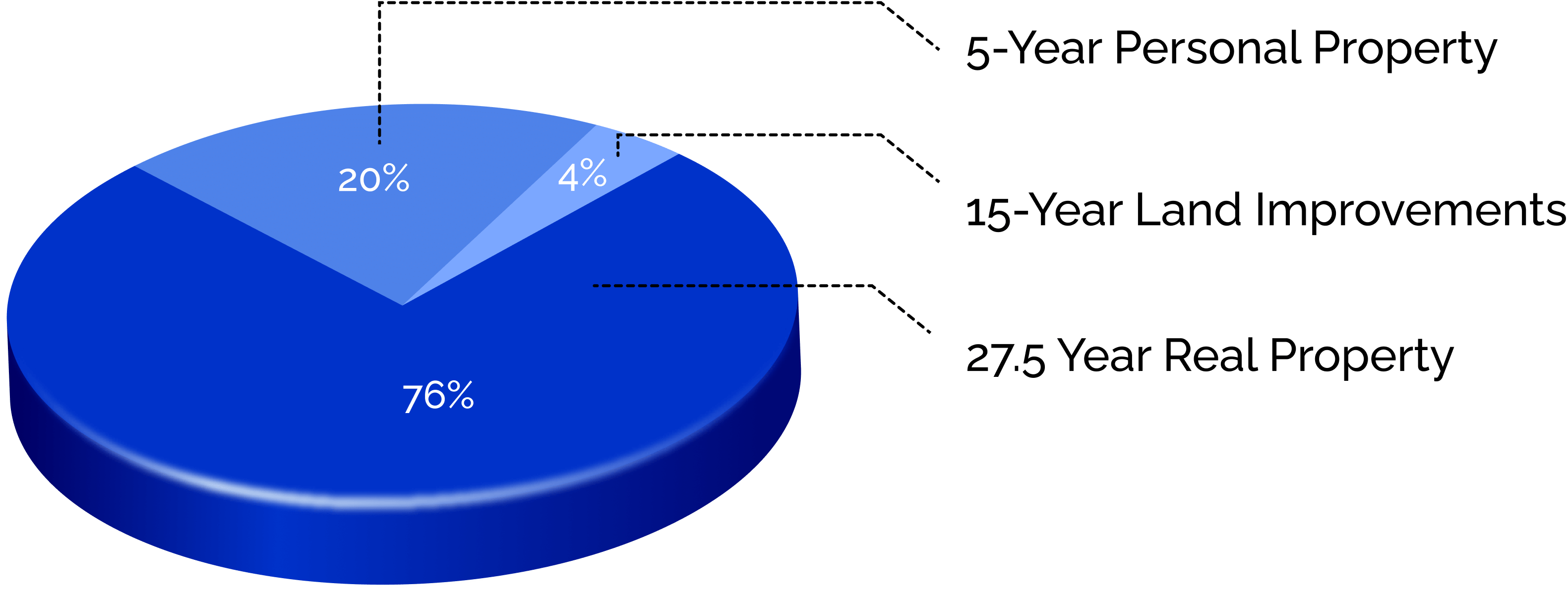

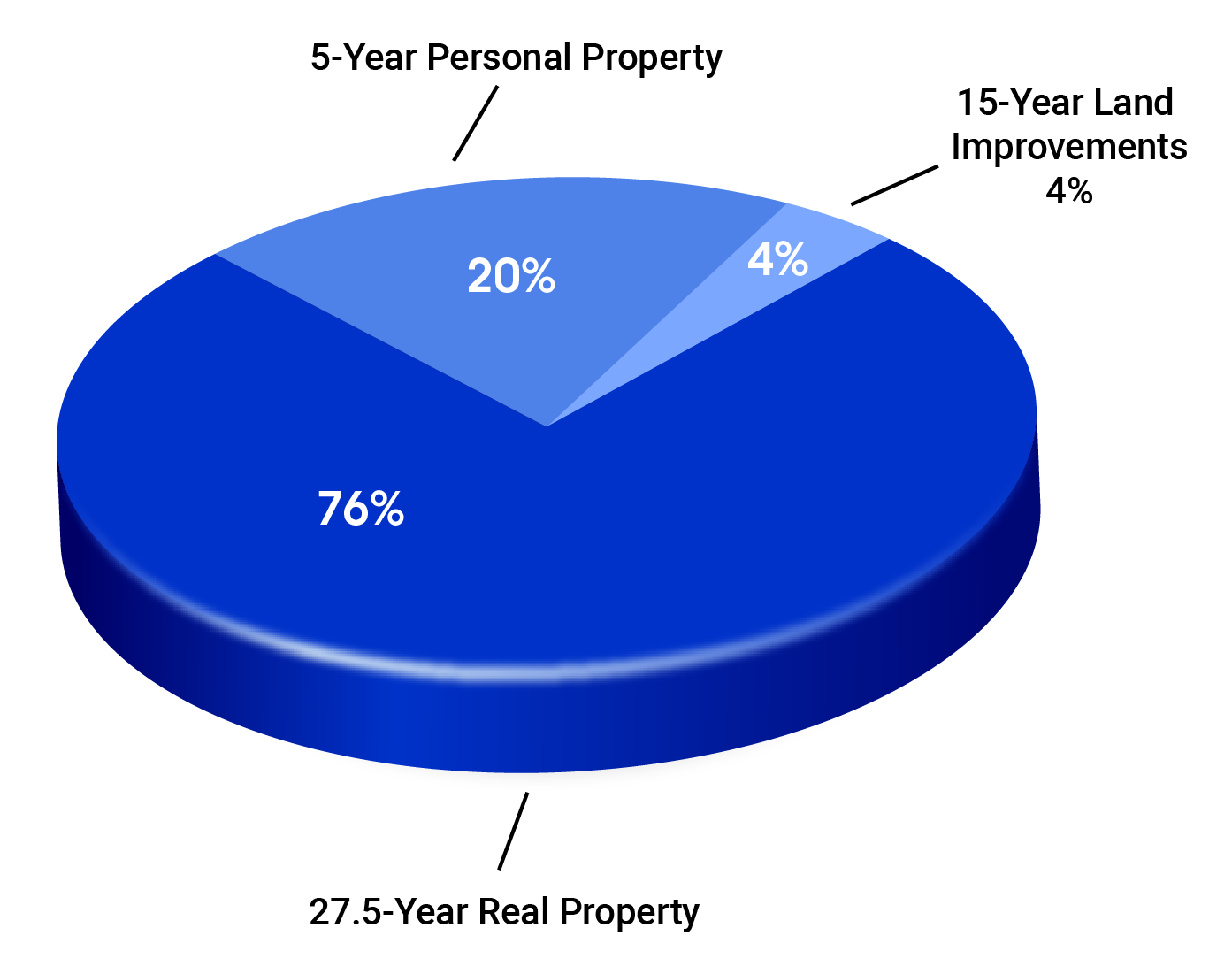

CRS reallocated a significant amount of the building assets to shorter depreciation periods, resulting in the following accelerated tax benefits and increased cash flow for the client.

Two years after the completion of the cost segregation study and subsequent 179D energy-efficient certification, our client was audited by the IRS on their federal taxes. Thanks to the diligent investigations, comprehensive analyses and thorough documentation submitted by the CRS team for both projects, our work was fully validated and there were no IRS changes at all to the tax return.

Take control of your property’s tax burden and discover the hidden potential in your assets.

© 2025 Cost Recovery Solutions LLC