The property is an automatic car wash in South Carolina that was acquired for $3,972,000 and placed in service in 2023. The 4,300 square foot building consists of a single lane for the car wash, 17 customer vacuum stations, pay stations located under individual canopies, and a small office.

Car washes generate an enormous amount of depreciation because the IRS uniquely qualifies the building itself as a special 15-year personal property asset rather than standard 39-year real property. However, CRS learned that not all of the building’s assets were actually part of this acquisition; we were tasked to read through the purchase agreement carefully to clarify what the owner was buying. Much of the car wash equipment that could potentially have been reallocated was excluded from the purchase and held by the tenant instead.

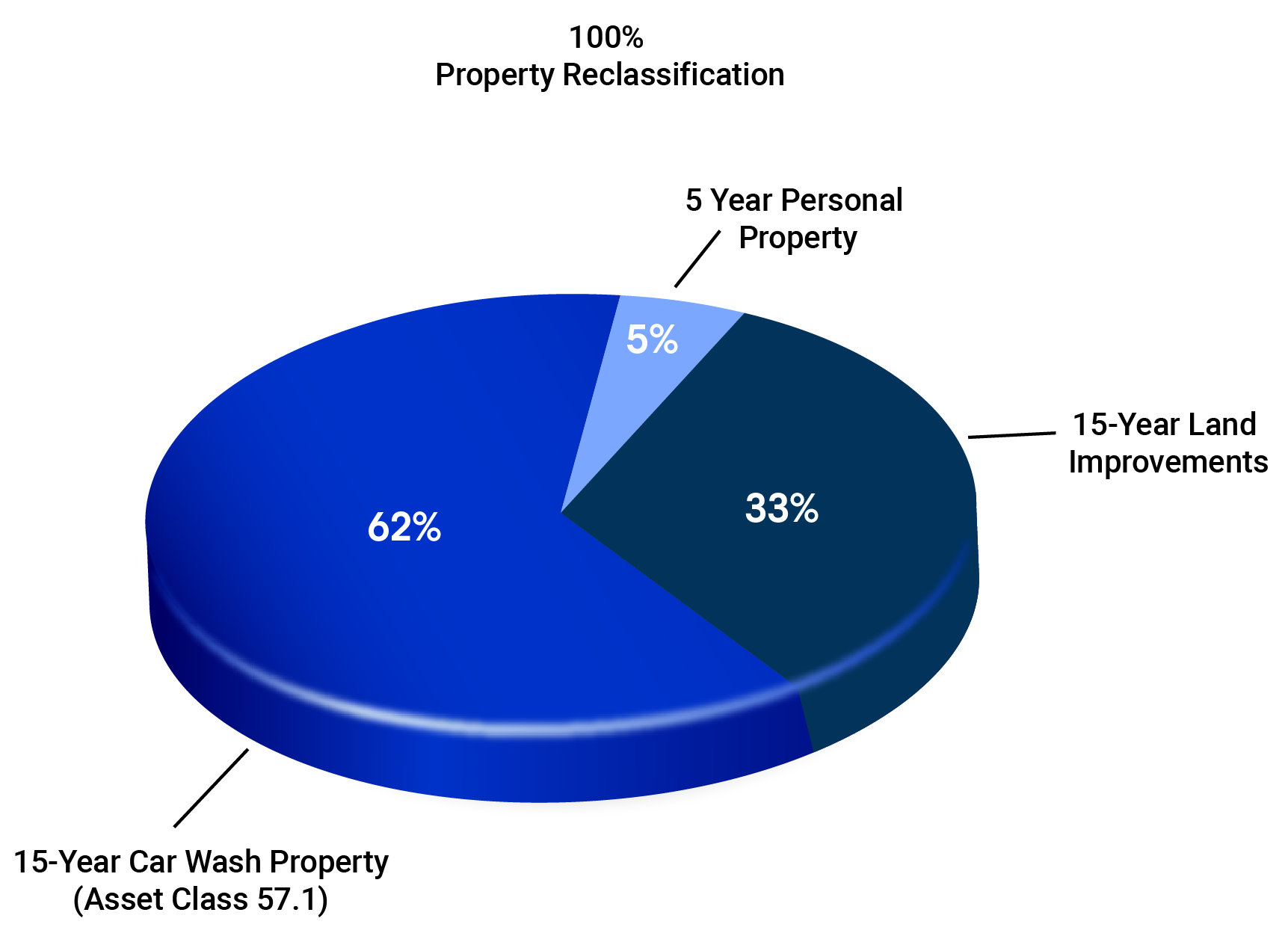

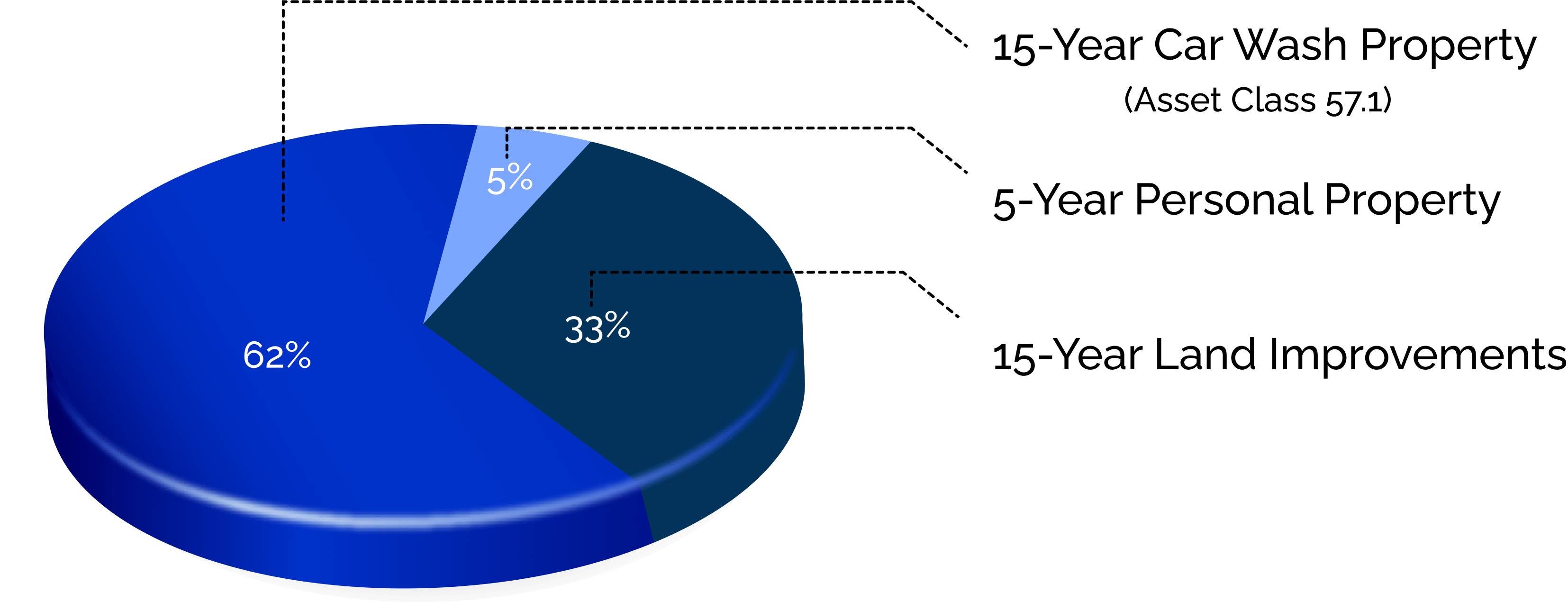

The specialized car wash asset class designation allowed by the IRS helped enable CRS to reallocate a full 100% of the building and its other assets to shorter depreciation periods, resulting in the following accelerated tax benefits and increased cash flow for the client.

Take control of your property’s tax burden and discover the hidden potential in your assets.

© 2025 Cost Recovery Solutions LLC