The property is a two-story, class-C office building in central New Jersey purchased for $2,050,000 and placed into service in 2019. The 17,100 square feet building includes a combination of 14 medical and standard office suites in varying sizes and a 2,700 square-foot common area.

Building assets include several types of flooring, millwork, shelving, cabinetry, window treatments, accent lighting, and reception features unique to each of the tenants and the common areas.

CRS was contracted in 2023 to perform a “retroactive” cost segregation study on the building, which is more challenging to analyze since it is performed several years after a building is purchased. Engineers had to look at what building assets existed when the building was purchased in 2019 compared to 2023 to properly determine their original cost basis, prior to any upgrades that could have been made. Adding to the complexity of gathering information was that many diverse types of tenant fit-outs were completed at various times over the building’s history (originally built in 1963). CRS also performed the study during COVID, making it more challenging to coordinate access to the office suites since many tenants were not working in the building.

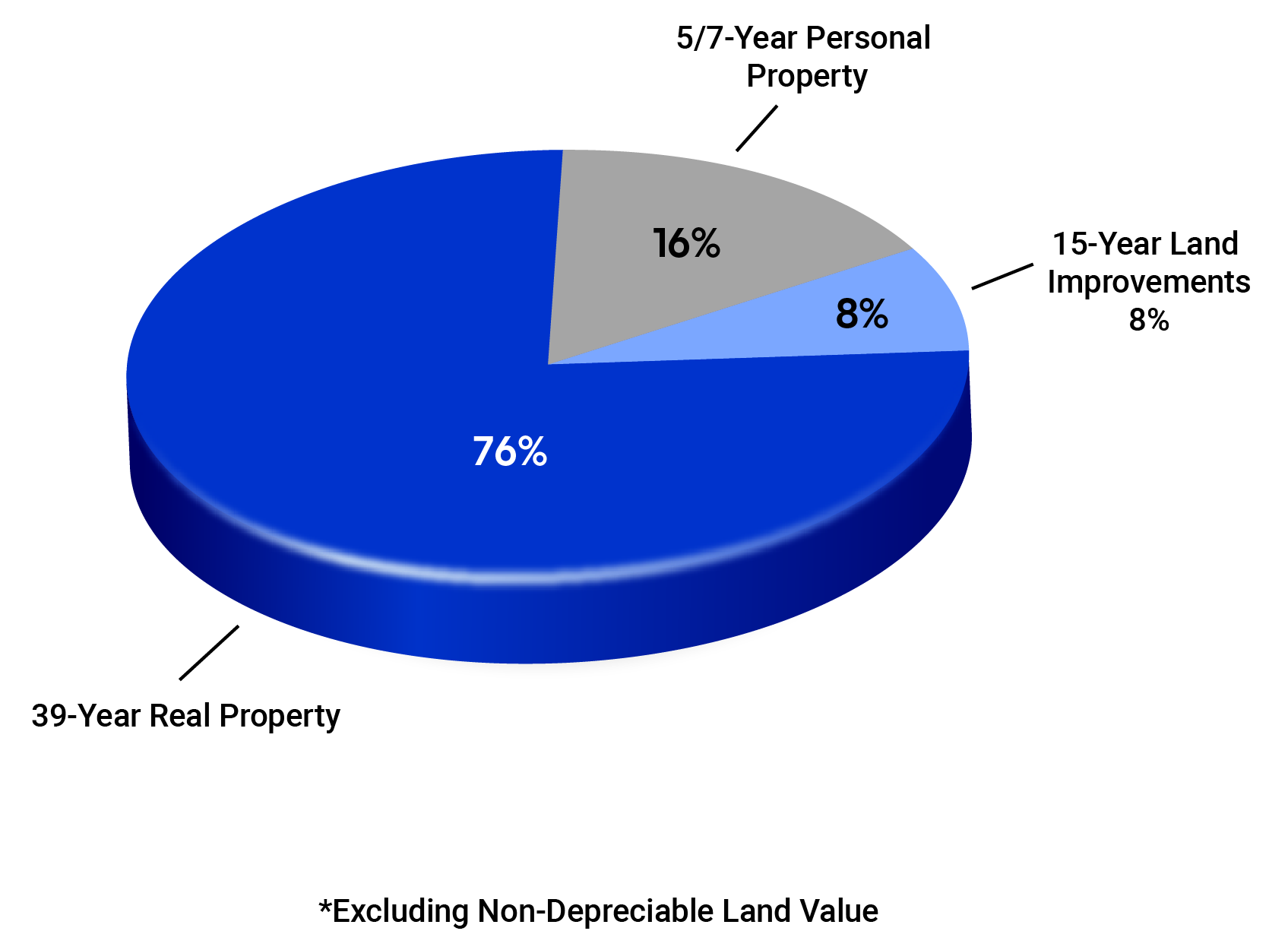

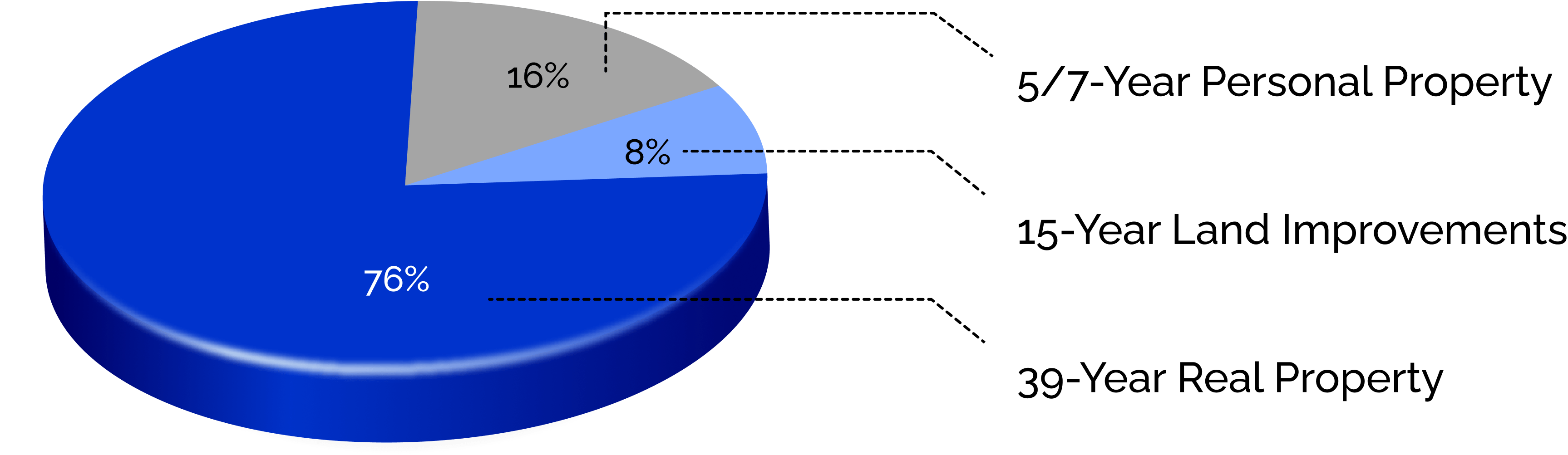

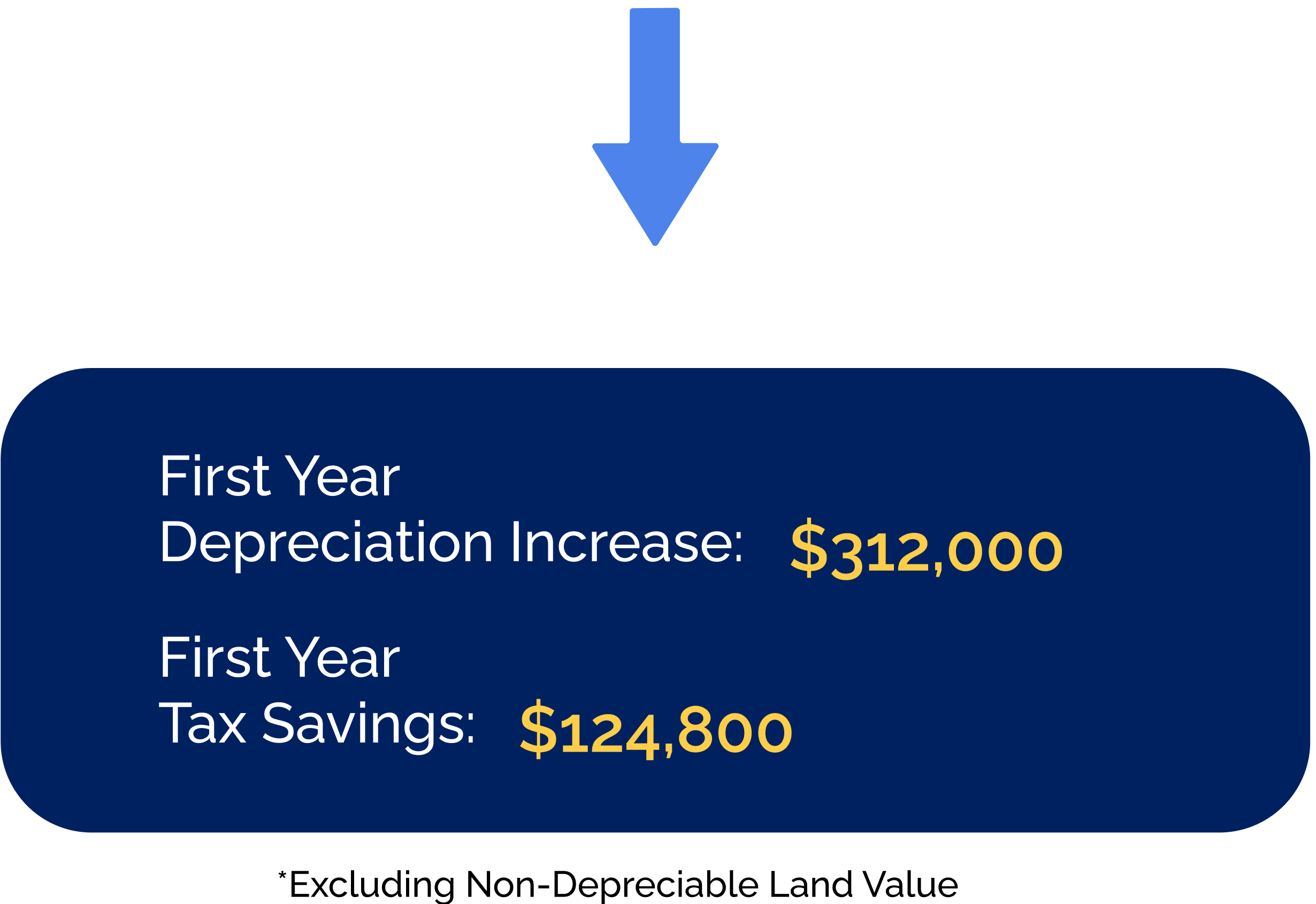

CRS reallocated a significant amount of the building assets to shorter depreciation periods, resulting in the following accelerated tax benefits and cash flow for the client.

Take control of your property’s tax burden and discover the hidden potential in your assets.

© 2025 Cost Recovery Solutions LLC