The property is a newly constructed indoor entertainment center located in eastern Massachusetts that was placed in service in 2019 at a cost of $16,056,000. The two-story, 125,000 square-foot facility includes two indoor kart tracks, a restaurant, gaming center, driver sign-in area, trampoline center, ninja course, party rooms and a large viewing mezzanine overlooking the kart tracks.

Detailed construction invoices are the key to maximizing the value of a cost segregation study. However, contractors usually do not break down their costs to the level of detail (as outlined by the IRS) that is fully advantageous to an owner. Using IRS-preferred methodologies and pricing sources, skilled CRS engineers were able to estimate the cost of various building systems and assets not typically found within standard construction invoices.

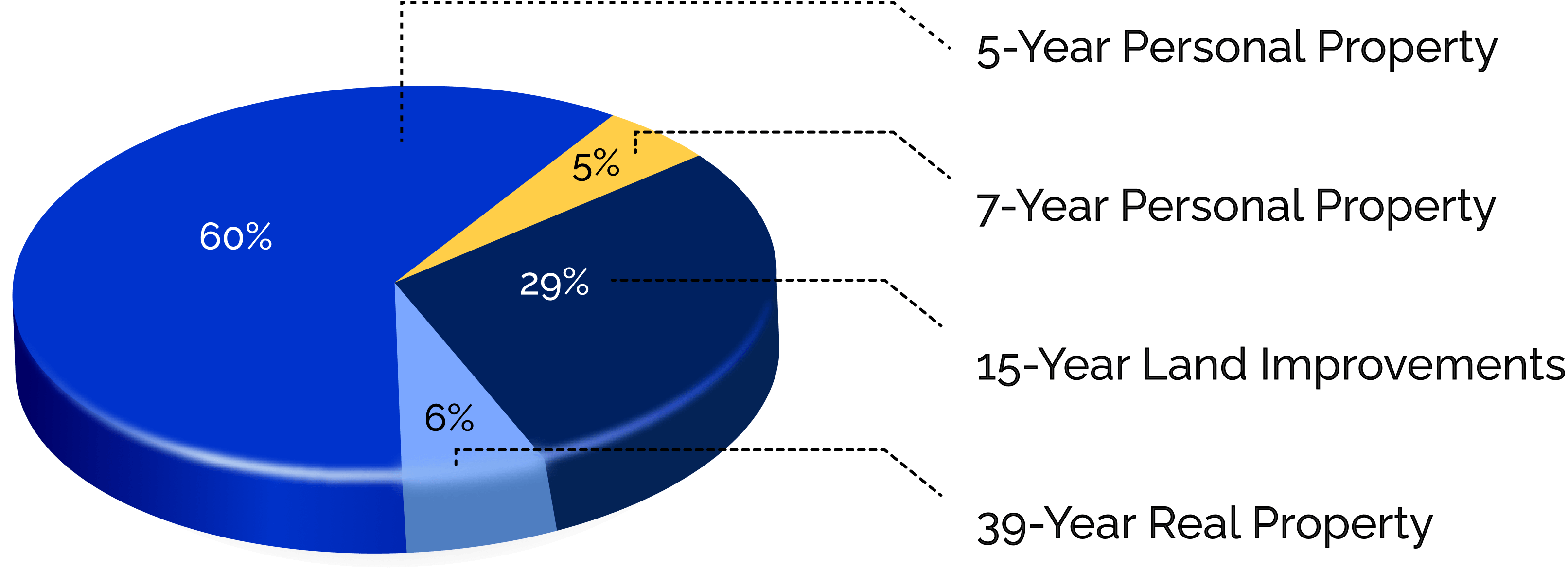

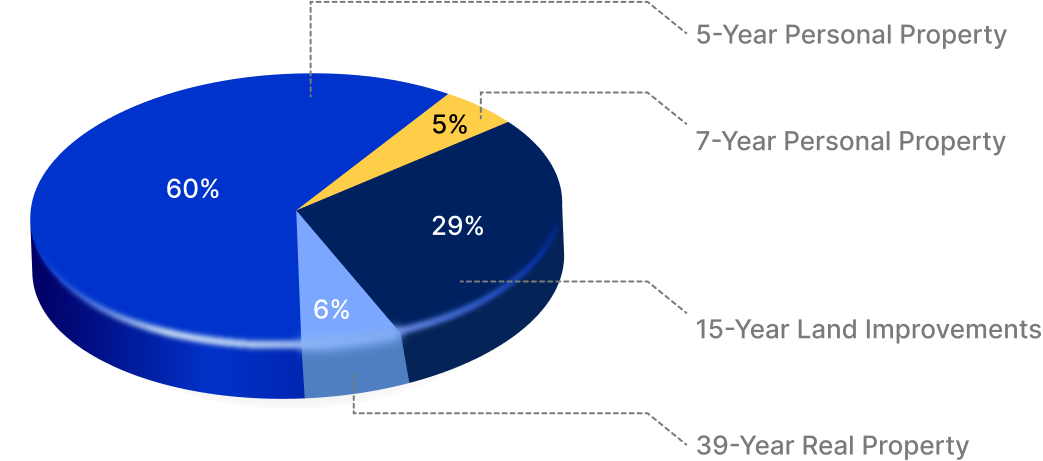

Elements of the property unique to entertainment centers generated a larger than usual amount of assets able to be reallocated to shorter personal property depreciation periods.

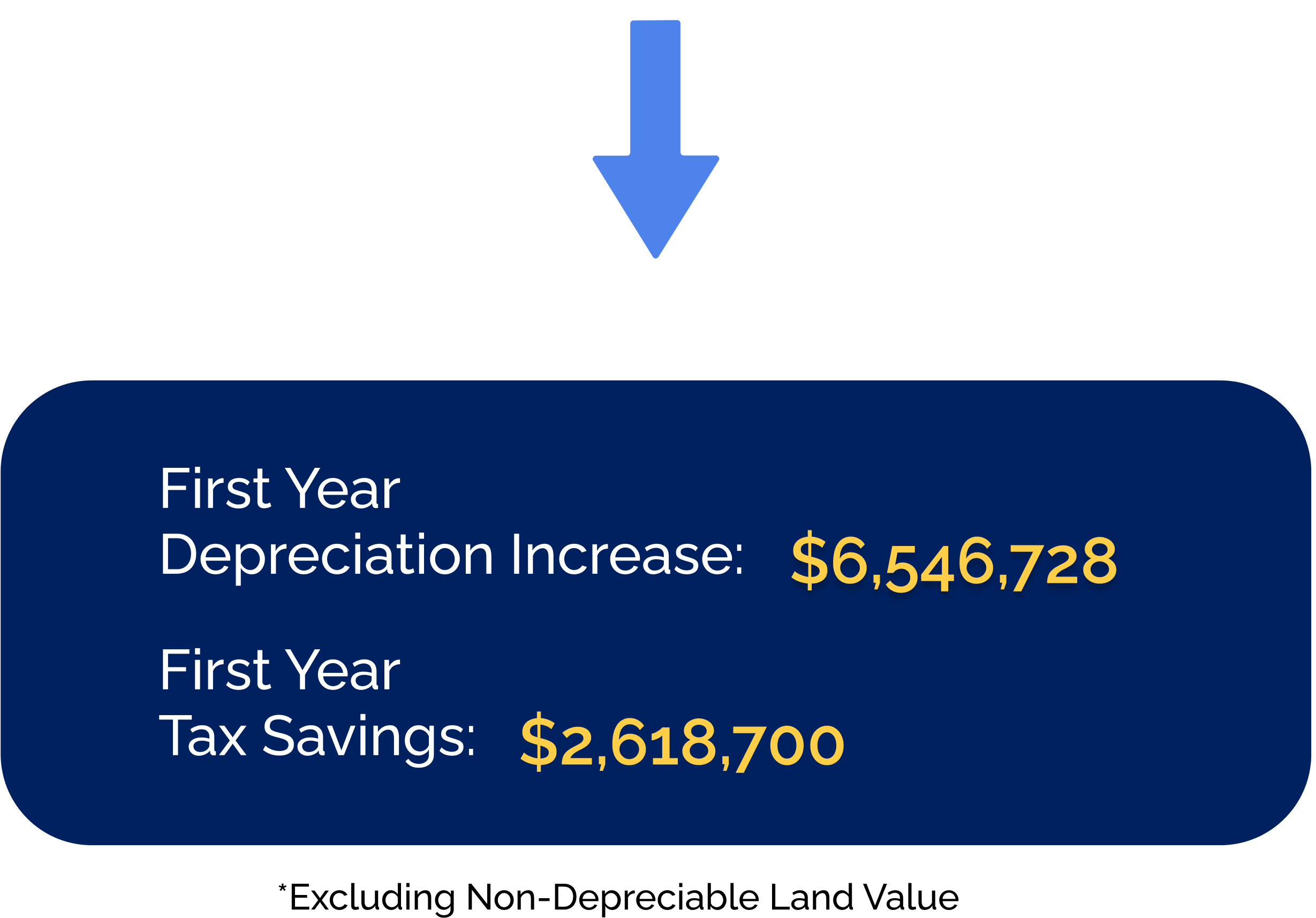

If the client had not performed a cost segregation study, 100% of the building assets would have been treated as standard “real property” using a “straight-line” method would only have generated first-year depreciation of $223,334.

CRS reallocated a significant amount of the building assets to shorter depreciation periods, resulting in the following accelerated tax benefits and cash flow for the client.

*Excluding Non-Depreciable Land Value

*Excluding Non-Depreciable Land Value

*Excluding Non-Depreciable Land Value

Take control of your property’s tax burden and discover the hidden potential in your assets.

© 2025 Cost Recovery Solutions LLC