The property is a warehouse/office building built in 1950 and purchased for $575,000 in 2021 by an internationally recognized seasonal entertainment park at the New Jersey shore. It was subsequently renovated with $494,000 worth of improvements and placed in service in 2022. The 9,700 square foot building originally consisted entirely of office space, most of which was then converted into a storage warehouse for the park’s entertainment equipment. The renovated space is now a combination of office, storage, and general warehouse areas. Major improvements included roof and parking lot repair / renovations, landscaping, new flooring, window treatments and specialty millwork throughout the renovated interior space.

CRS was contracted to perform the cost segregation study after the building had already been gutted. While only parking lot renovations could be reallocated to a lower depreciation period on the acquisition, the interior improvements qualified for a special asset class called Qualified Improvement Property (QIP). When a building is renovated, many interior assets that normally would be allocated to a 39-year depreciation schedule are then eligible for a 15-year schedule instead. Our engineers were challenged to discern between improvements made to the structural and building envelope versus interior modifications. The QIP classification also includes any demolition completed to prepare for the interior improvements. QIP on this property was significant, enabling the client to gain substantial tax benefits.

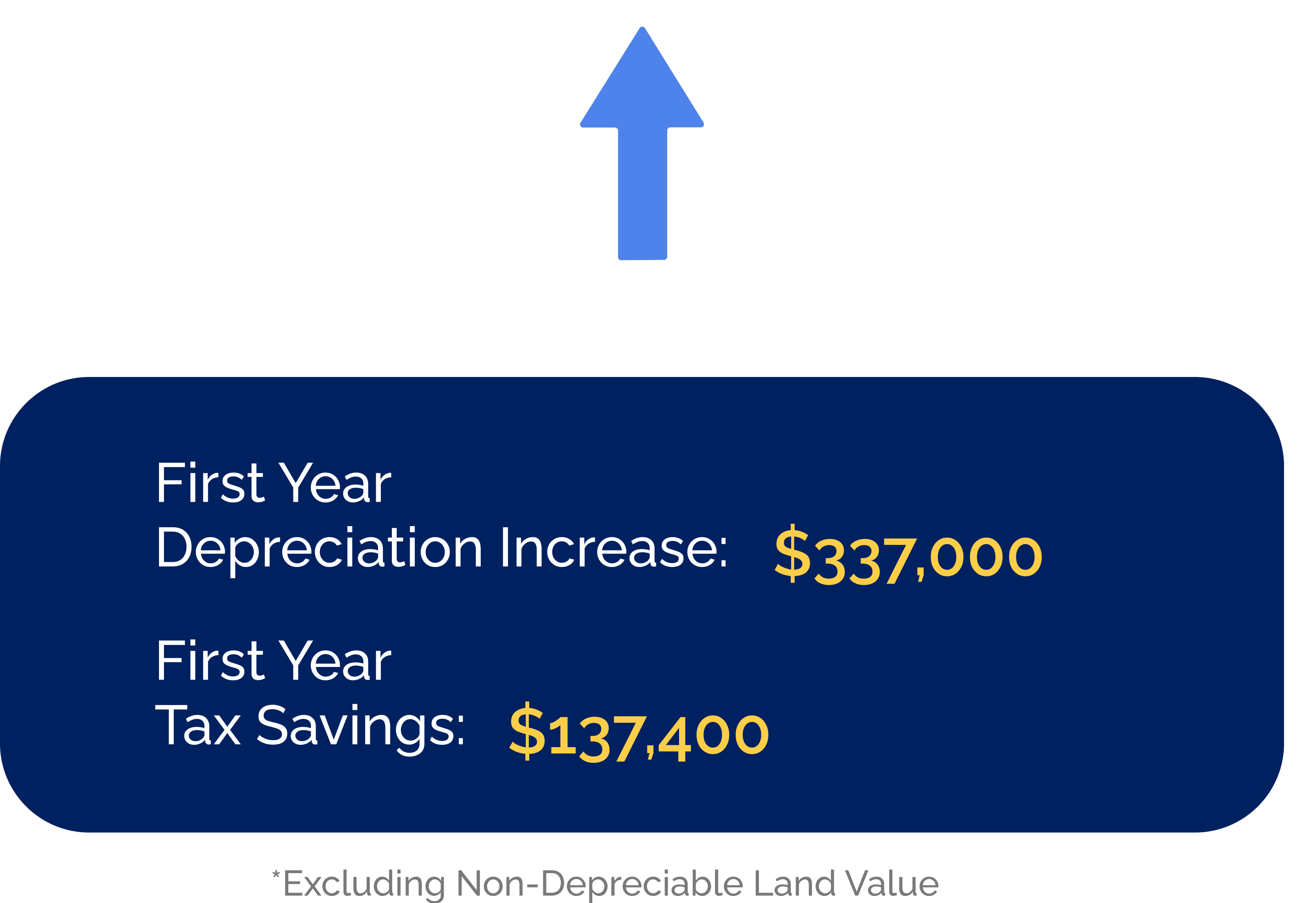

If the client had not performed a cost segregation study, 100% of the building assets would have been treated as standard “real property” for commercial property using a “straight-line” method that would only have generated first-year depreciation of $2,500 for the acquisition and $10,000 for the improvements.

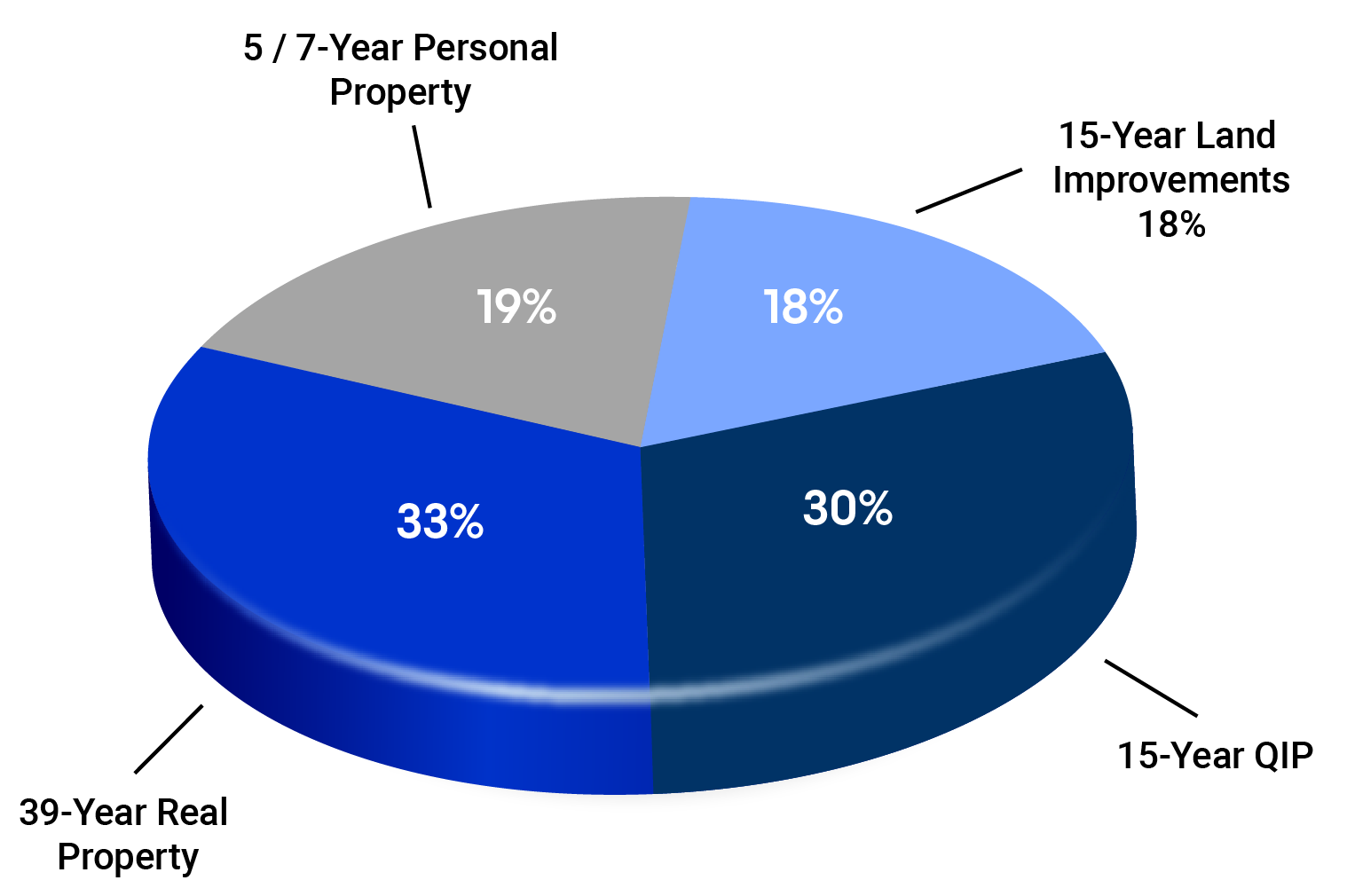

CRS reallocated a significant amount of the building assets to shorter depreciation periods, resulting in the following accelerated tax benefits and cash flow for the client.

Take control of your property’s tax burden and discover the hidden potential in your assets.

© 2025 Cost Recovery Solutions LLC