The property is an industrial warehouse for a manufacturing company. The client acquired a 63,000 square foot building in 2020 and subsequently completed a 30,000 square foot expansion in 2022 at a cost of $2,323,000. The single-story building includes 32-foot ceilings, with the pre-manufactured steel addition extending along the same lines as the existing structure. The expansion added three loading docks, more manufacturing and warehousing areas, two bathrooms, and a new break room.

Building additions are challenging to analyze; rather than working with a blank slate as with new construction, components such as electrical, plumbing and HVAC systems in the existing building are often being partially or completely replaced. Contractors do not separate out these costs, so CRS engineers needed to thoroughly investigate how the old and new systems and materials were integrated to correctly determine which can be reassigned to lower depreciation periods.

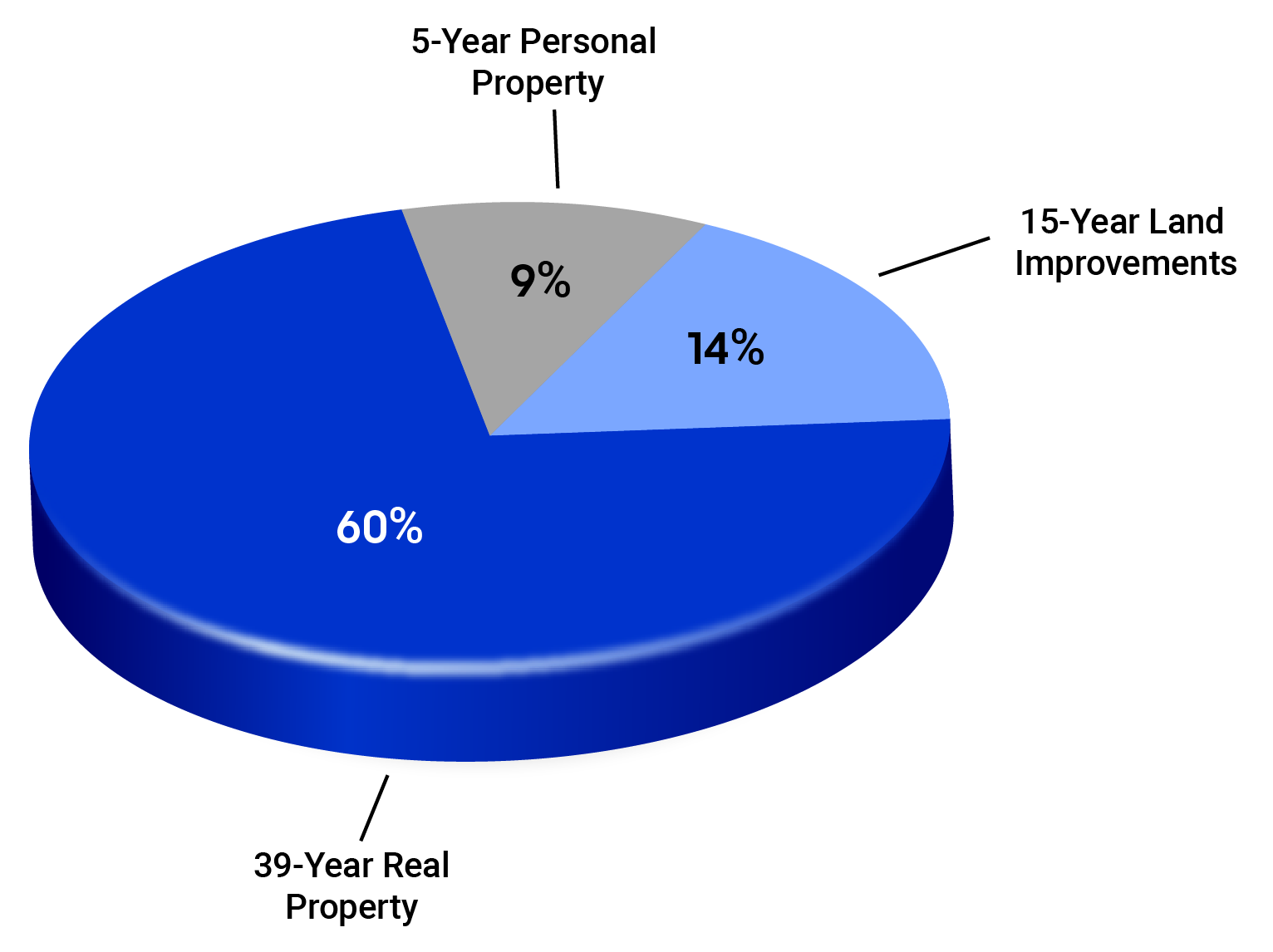

If the client had not performed a cost segregation study, 100% of the expansion assets would have been treated as standard “real property” using a “straight-line” method that would only have generated first-year depreciation of $42,300.

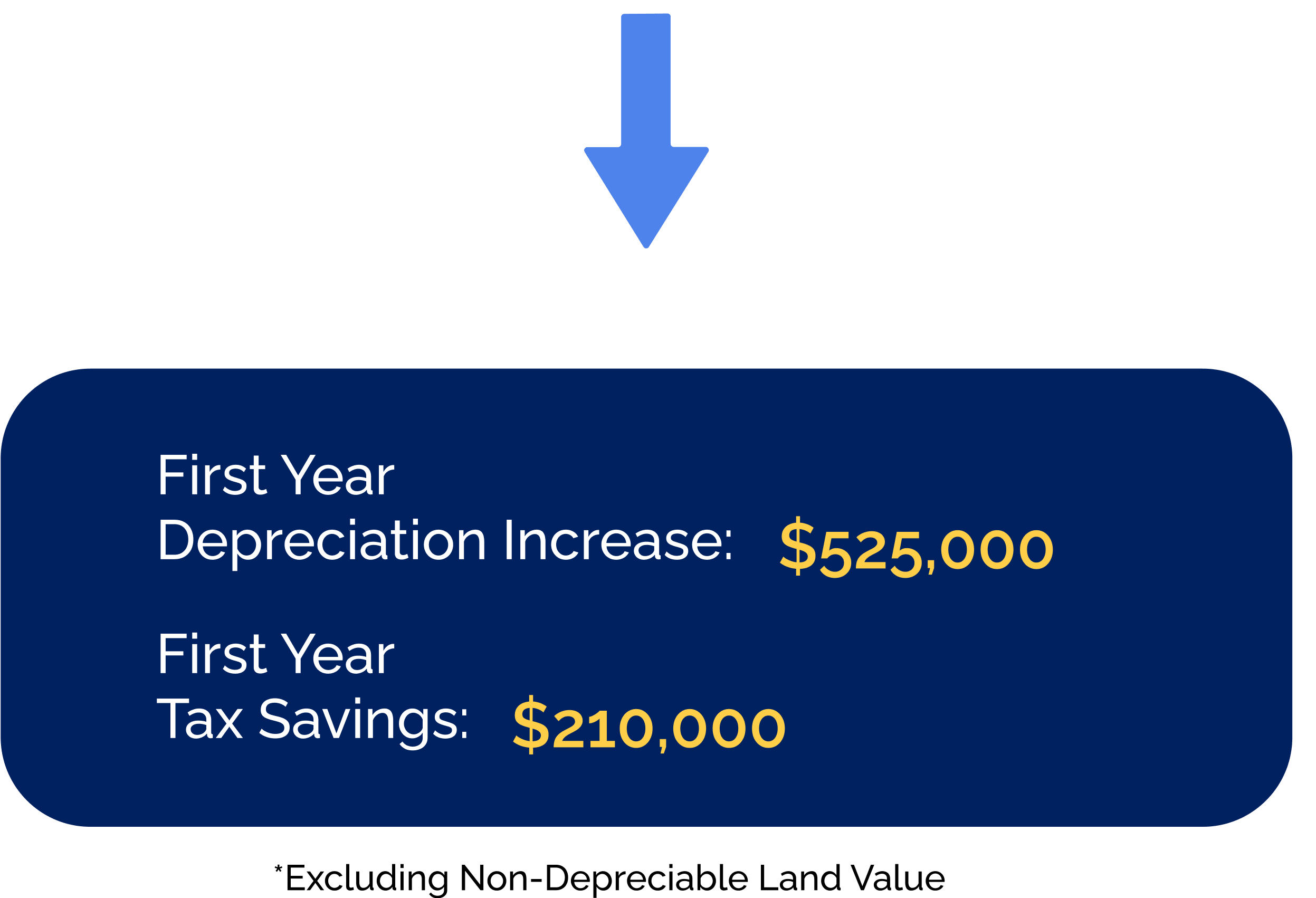

CRS reallocated a significant amount of the expansion assets to shorter depreciation periods, resulting in the following accelerated tax benefits and cash flow for the client.

Take control of your property’s tax burden and discover the hidden potential in your assets.

© 2025 Cost Recovery Solutions LLC