The property is a newly constructed, luxury six-story apartment building located in northern New Jersey that was built at a cost of $17,775,000 and placed in service in 2024. The 64,000 square foot building includes 60 studio, one- and two-bedroom apartment units and a two-level parking garage. Amenities include community rooms and a fitness center.

Detailed construction invoices are the key to maximizing the value of a cost segregation study. However, contractors usually do not break down their costs to the level of detail (as outlined by the IRS) that is fully advantageous to an owner. Using IRS-preferred methodologies and pricing sources, skilled CRS engineers were able to estimate the cost of various building systems and assets not typically found within standard construction invoices.

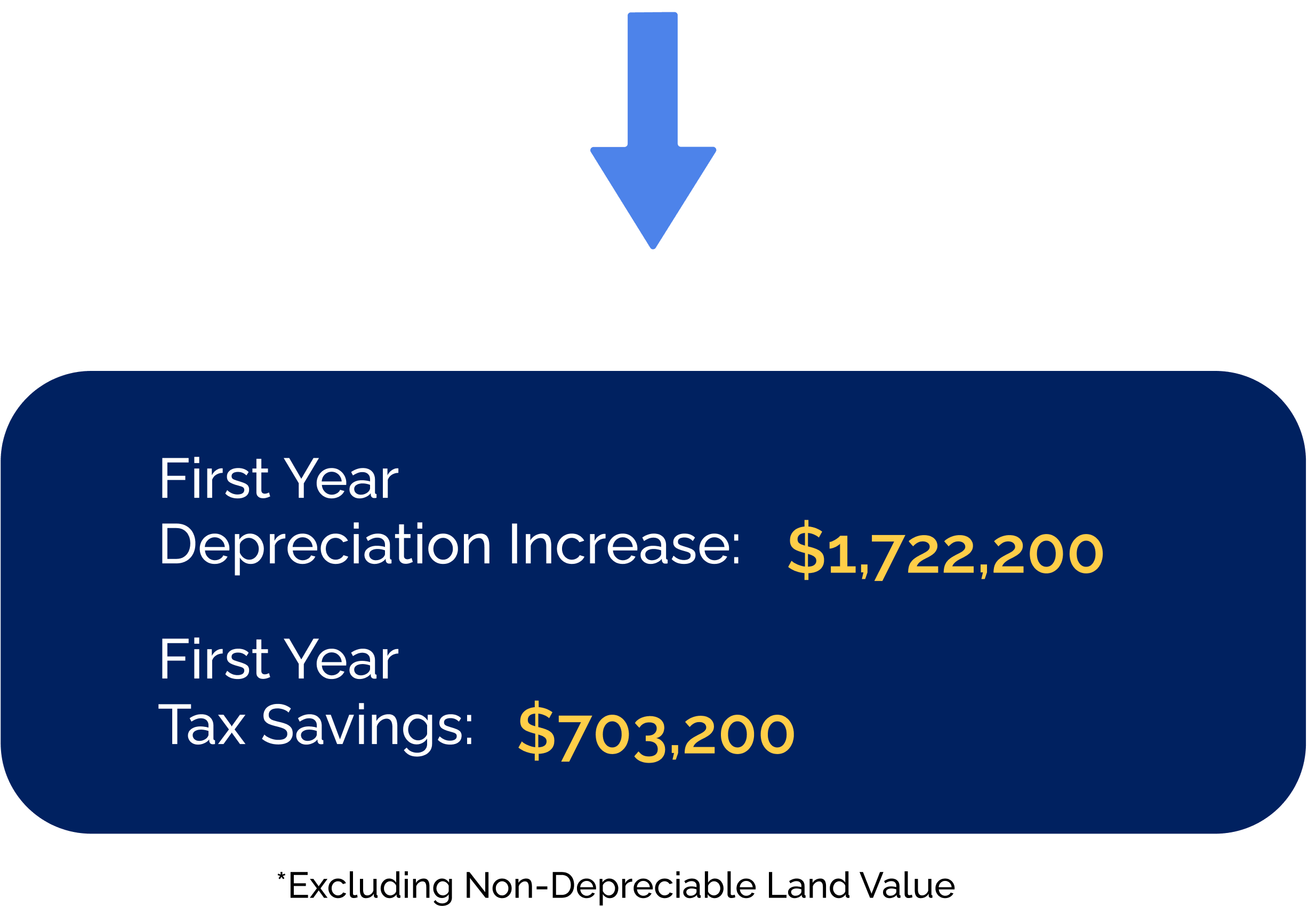

If the client had not performed a cost segregation study, 100% of the building assets would have been treated as standard “real property” for residential rentals using a “straight-line” method that would only have generated first-year depreciation of $565,600.

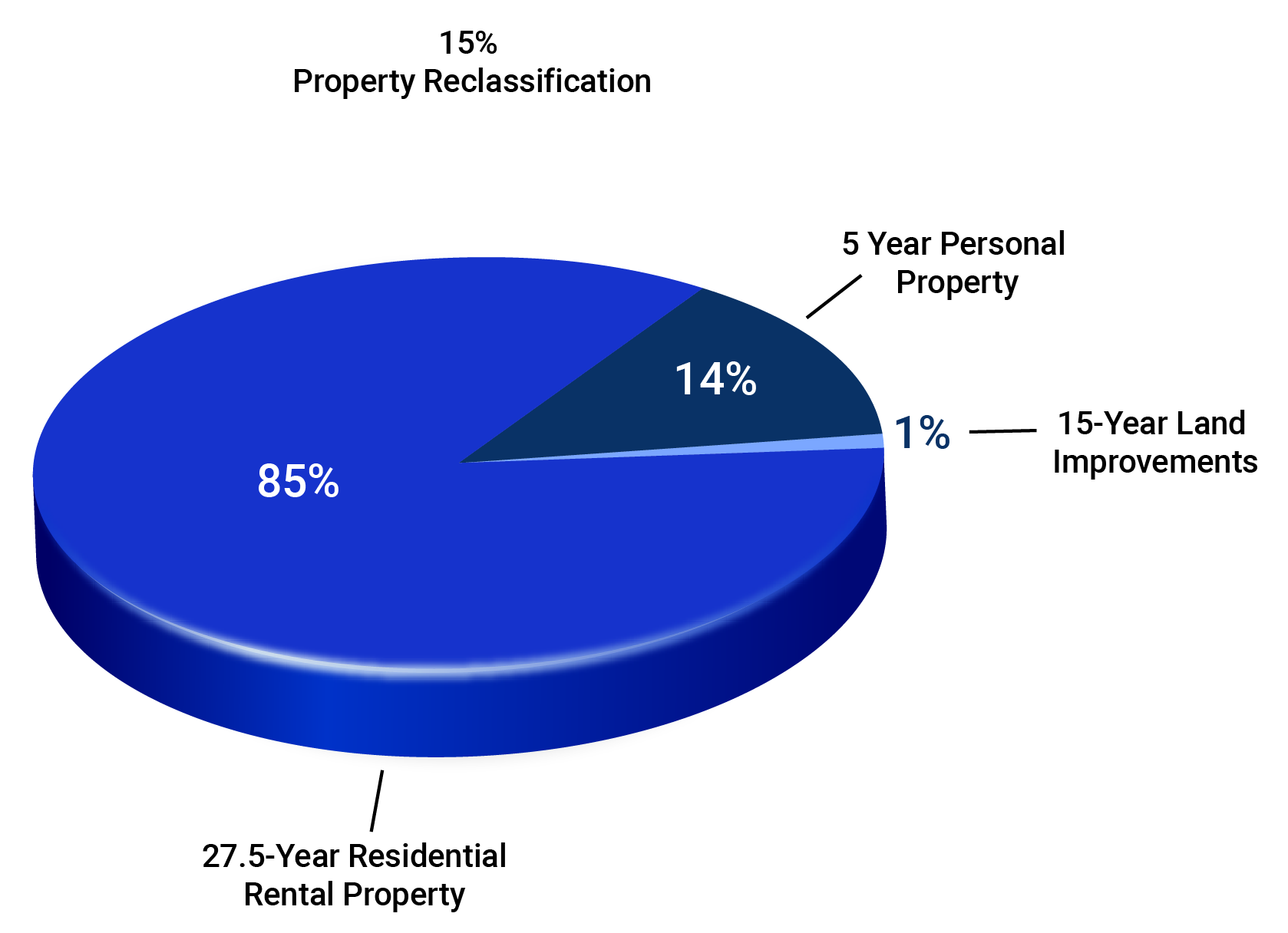

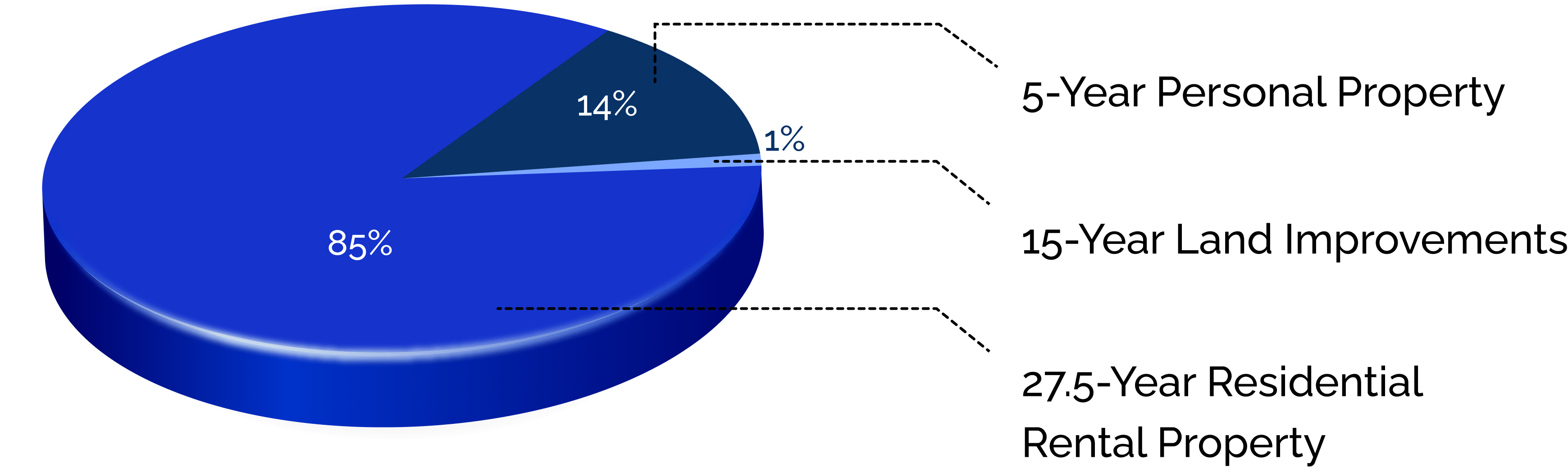

CRS was able to reallocate a significant amount of the building assets to shorter depreciation schedules, resulting in the following accelerated tax benefits to the client.

Take control of your property’s tax burden and discover the hidden potential in your assets.

© 2025 Cost Recovery Solutions LLC