Breaking Down the Basics with an Expert

As we all face the daunting process of filing our taxes, one powerful tool that can help defer taxable gain on real estate transactions is a 1031 exchange. This month we welcome guest author Jim Gudenau. Jim is a 1031 exchange manager with Leader1031 (a wholly-owned subsidiary of Leader Bank, N.A.), a premier lending institution serving clients for over 20 years. Jim explains the basics of Internal Revenue Code Section 1031 and the exchange transaction.

What is 1031?

Are you an investment property owner looking to sell your current property and acquire a new investment property?

With a 1031 tax-deferred exchange, you’ll be able to sell your current property, reinvest the proceeds into a new investment property and defer taxes on the sale.

So how exactly does one qualify for a 1031 exchange?

To qualify, IRS guidelines require several requirements to be met:

- The property must be owned for business use, production of income or investment (non-personal use) purposes.

- The property being sold (Relinquished Property) and the property being acquired (Replacement Property) must be like-kind, which simply means that they both must be held for one of the purposes mentioned above.

- 1031 exchanges can only involve real property, and the sale and subsequent purchase must be structured as an exchange.

- An important part of a 1031 exchange is making sure you have an expert to help you navigate the process. In most circumstances, the property owner (or the “Exchangor”) must engage the services of a Qualified Intermediary (or QI), an independent third party that helps facilitate the exchange.

Additionally, QIs cannot be someone who has acted as an agent of the Exchangor in the past two years including, but not limited to, their attorney, accountant, investment banker, broker or real estate agent.

What’s involved in the 1031 exchange process?

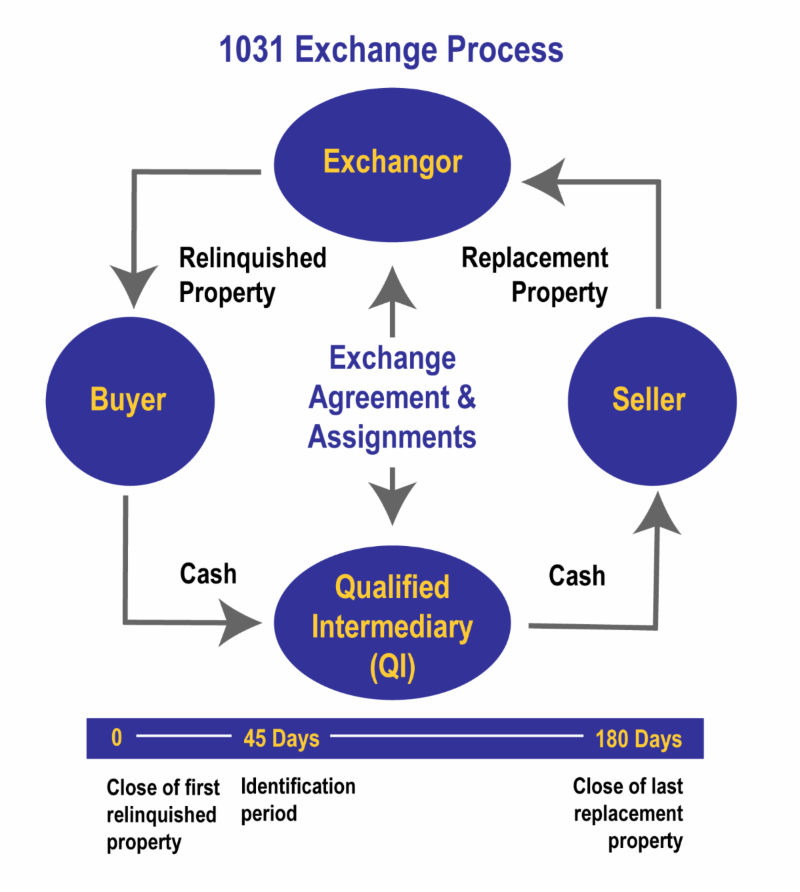

The required steps to complete a 1031 exchange include those in the graphic.

The property owner must engage the services of a QI prior to the closing of the Relinquished Property. The QI will draft the exchange documents and coordinate with the closing agent to ensure that the exchange is properly documented and that necessary changes are made to the settlement statement. The closing agent will then send the proceeds from the sale directly to the QI.

From the date of closing on the Relinquished Property, the clock on the exchange starts ticking on two significant deadlines. The property owner has:

- 45 days to identify potential Replacement Property

- 180 days to close on the acquisition of the Replacement Property

These deadlines run concurrently, based on calendar days including holidays and weekends. If the due date of the Exchangor’s tax return occurs prior to the 180th day, all Replacement Property must be acquired prior to that date unless they file an IRS extension.

What rules apply to identifying the Replacement Property?

Exchangors can use one of three types of rules to identify potential Replacement Property:

- Three-Property Rule – most commonly used, allows the Exchangor to identify any three properties regardless of value.

- 200% Rule – allows the Exchangor to identify more than three properties, as long as the aggregate fair market value of the identified properties does not exceed 200% of the fair market value (FMV) of the Relinquished Property (e.g., a $1,000,000 Relinquished Property FMV would allow up to $2,000,000 in value for the identified properties).

- 95% Rule – used if more than three properties have been identified and the aggregate value exceeds 200%. In this case, 95% of all identified properties must be acquired or the entire exchange fails.

The Exchangor must provide the QI with written identification prior to midnight of the 45th day. Any property that has been acquired prior to the 45th day is considered properly identified.

To what extent can the QI guide the Exchangor?

The role of the QI is to educate the Exchangor and navigate the time constraints, identification rules, escrow of proceeds and become an integral part of the client’s professional team. For example, you can click here to learn more about common misconceptions involved in the process. However, it is imperative that the property owner consult with tax counsel prior to and during the exchange. The QI cannot provide legal or tax advice, and the property owner must rely on the advice of their own counsel.

For more details on the 1031 process, contact Exchange Manager Jim Gudenau at https://www.leaderbank.com/business/leader-1031/

The content of this communication is provided as general information only and should not be taken as legal, investment or other professional advice; it shall not be construed as a recommendation to participate in any specific financial or investment strategy, and neither Leader Bank, NA nor Leader1031 can provide legal or tax advice concerning the specific tax consequences of a given transaction. Any action that taken due to the information or opinions provided in this communication is ultimately your responsibility. Consult your attorney, accountant, or tax professional before making any investment or financial decisions.