Happy New Year! To help facilitate a hopefully bright and successful 2023 for our clients, we want to pass along a few updates to articles we’ve recently written about key tax incentives benefiting commercial property owners, investors and the financial professionals who serve them. These include highly anticipated Federal guidance on provisions within the Inflation Reduction Act of 2022 (IRA) affecting energy-conscious owners, builders and designers, a glimmer of hope that could possibly reinstate one of the most beneficial incentives ever back to its full benefit and cautionary advice due to increases in IRS funding. Here’s the latest on each:

179D ASHRAE Standards

Passed into law last August, the IRA increased the 179D tax deduction for building investments in energy-efficient lighting, HVAC, or building envelope components from a maximum of $1.88/sq ft up to $5.00/sq ft beginning in 2023. At first glance, this was welcome news since it is a significant increase in potential tax savings for investors (and/or designers and builders of non-profit building projects).

Then came the catch! To qualify for the incentive prior to 2023, projects had to achieve energy improvements based on older American Society of Heating, Refrigerating and Air Conditioning Engineers (ASHRAE) code standards dating back to 2007. However, initial documentation in the IRA indicated that these improvements would now have to meet more current and stringent ASHRAE standards. The lack of required official guidance from the Treasury and IRS left all who could benefit from the deduction (and their tax professionals!) confused and wondering what the final standard changes would be and when they would actually take effect.

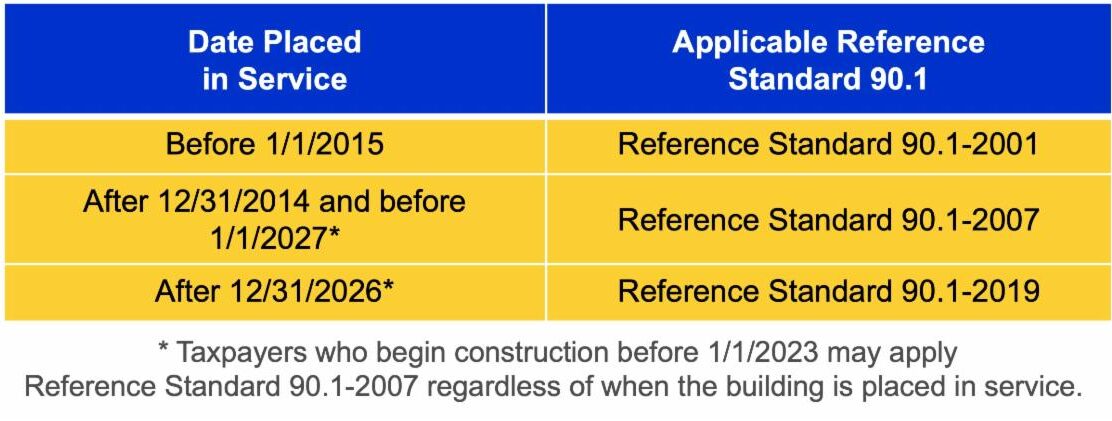

Late last month, the IRS finally issued Announcement 2023-1 affirming the standards to be used and their respective timetables, as detailed in the table below:

The good news for investors is that the reference standard for projects that either began construction by 12/31/2022 or will be placed in service before 1/1/2027 will continue to be ASHRAE 90.1-2007. At that time the standard will change to the 2019 version. This is a great incentive for energy-conscious owners to begin their projects as soon as possible to gain maximum tax benefits.

179D and 45L Prevailing Wage Requirements

At the end of November 2022, the IRS issued Notice 2022-61 to clarify significant changes to prevailing wage and apprenticeship requirements that must be met to gain tax benefits under the IRA starting in 2023. These apply to both 179D deductions and 45L tax credits for smaller building projects (which can earn up to $5,000/unit). The guidance included:

- What constitutes a prevailing wage based on geographic area, type of construction and labor classifications

- Definition of a qualified apprenticeship

- What determines “beginning of construction” and “installation” required dates to earn the tax benefit

- Record keeping requirements to determine proof that prevailing wages are paid

The bad news: beginning on 1/29/2023 if these requirements aren’t met, the maximum 179D deduction decreases five-fold down to a maximum of $1.00/sq ft, and the 45L credit decreases down to a maximum of $1,000/unit. The good news (for some) is that projects beginning before 1/29/23 and single-family homes won’t be required to comply with these requirements to qualify for the higher deductions or credits.

100% Bonus Depreciation

As many know by now, the IRA failed to extend the Tax Cuts and Jobs Act (TCJA) provision that had given investors the option to apply 100% bonus depreciation on qualified property since 2017. Instead, this major incentive to invest in building improvements is now scheduled to phase down by 20% each year beginning in 2023 until it expires in 2027. However, there was bi-partisan support for bills presented in both the House and Senate to make the incentive permanent back in 2021 (although neither made it to the most recent spending package enacted last month). Now that the House is controlled by Republicans who have indicated they will seek to preserve some of the original TCJA tax cuts, there may be a chance for consensus on repealing the phase out. So investors shouldn’t give up hope that this incentive may be extended, which would allow them to be more certain of recovering their costs when making critical capital investment decisions.

IRS Funding Increase

One more IRA provision to note is the significant increased funding levels for the IRS. Even though the new House may push through a roll-back of some of it, greater enforcement of tax laws is likely to continue for years to come. Therefore, property owners and tax preparers must be even more diligent in ensuring that studies supporting cost segregation and 179D certifications are completed by ethical, highly qualified providers to avoid and defend any audit should it occur.

CRS will continue to update you on additional Treasury and IRS developments as they become available, as well as any action Congress takes that would affect bonus depreciation schedules. In the meantime, we recommend if you or a client is close to beginning construction or placing it in service to do so as soon as possible to gain the maximum flexibility for meeting new requirements and gaining tax breaks.